Dear Neighbor,

While the start of spring often brings more sunshine and longer days, it can also bring frequent temperature changes, and with that, severe weather. I try to stay well- informed, prepared, and alert for extreme weather events this spring. I hope you will too!

Taxes are due this week! Read on to learn more about how my colleagues and I have fought for lower taxes and higher returns for working families ahead of the filing deadline, today, Tuesday, April 15, 2025.

As always, please feel free to reach out to share your thoughts or seek assistance with any challenges you may be facing with state departments. You can email me at sensshink@senate.michigan.gov or call (517) 373-2426. Also, please visit my official Facebook page for the latest updates.

Sincerely,

Sue Shink

State Senator

14th Senate District

- Please join Gov. Gretchen Whitmer and me for a tele-town hall tonight Tuesday, April 15, from 6:45 to 7:30 p.m. You can RSVP at SenatorShink.com/Events.

- April is tax month! Learn how my colleagues and I are fighting to put more money back into your pockets ahead of the April 15, 2025, tax filing deadline.

- Please join me for my upcoming community conversation event at Webster Township Hall on Wednesday, April 23 at 6:00 p.m.

- With Michigan individual income tax filing season winding down, the Michigan Dept. of Treasury is reminding Michiganders to be cybersecurity aware and prepared to fight tax-related identity theft. Read on to learn how you can be cybersecurity aware.

Michigan Senate Continues to Fight for Teachers, First Responders & Corrections Officers

Despite a recent Court of Claims ruling in favor of the Senate Majority Leader in Michigan Senate v. Michigan House of Representatives — making it very clear that the Michigan Constitution requires every bill passed by the Legislature to be presented to the governor — the House continues to unlawfully withhold nine critical bills.

These bills would provide much-needed cost-saving relief to Michiganders, a need that has only grown more urgent in the wake of Donald Trump’s disastrous trade war and the resulting stock market crash.

We recognize the importance of these bills and the relief they offer. We are grateful that the Michigan Supreme Court has ordered the Court of Appeals to swiftly take up the matter. The Senate remains committed to pursuing every legal avenue available to ensure these bills get signed into law.

But the fastest way to resolve this issue and deliver real relief to people across our state is for House Republicans to stop playing political games and to fulfill their constitutional duty to deliver these bills to the governor.

The lawsuit was brought by Leader Winnie Brinks after House Speaker Matt Hall failed to present nine bills that passed both chambers to Gov. Gretchen Whitmer. The bills — House Bills 4177, 4665-4667, and 4900-4901 of 2023 and House Bills 5817-5818 and 6058 of 2024 — improve retirement benefits for state corrections and conservation officers as well as lower health care costs for firefighters, teachers, and other public sector employees.

A People-First Budget for Michigan

Right now, my colleagues and I are working hard to craft Michigan’s next state budget. We believe that the budget should address the real needs of everyday Michiganders and serve the hardworking taxpayers who fund it.

We know the decisions we make will shape the future of our state. That’s a responsibility I don’t take lightly — and I’m proud to work alongside my colleagues to deliver a budget that puts people first. What are some things that you want to see prioritized in the next state budget? Let me know at SenSShink@senate.michigan.gov.

It’s Tax Month! Working to Maximize Your Return

The rising cost of living continues to make it more difficult for Michigan families to get by — that’s why my colleagues and I have fought hard to cut taxes and lower costs for our residents.

Last session, we passed the historic Lowering MI Costs Plan — the biggest tax relief initiative Michigan has seen in decades. This plan repealed the unfair retirement tax to help seniors save an average of $1,000 annually and provided the largest tax break for working families in state history, helping them save an average of $3,150 or about $9.75 million across Senate District 14.

Taxes are due this week on Tuesday, April 15, 2025. To learn how to take advantage of these expanded benefits and maximize your tax return, click here.

Holding the Trump Administration and DOGE Accountable

Building on previous work Senate Democrats have done to expose and highlight the consequences the federal funding freeze is having on public safety as well as on Michigan children, seniors, and families, my colleagues and I came together to speak out to protect Michiganders’ health care and private data.

Protecting Health Care Access

Last month, Republicans in Washington voted for a budget resolution that paves the way for massive, indiscriminate cuts to Medicaid. And as the federal Dept. of Government Efficiency (DOGE) seeks to slash enough from the federal budget to pay for a tax break for the wealthiest 1% of Americans, Medicaid is among the critical programs on the chopping block.

To protect the 2.6 million Michiganders — including children, seniors, and veterans — who rely on Medicaid for essential health care services, including doctors visits and senior care, my colleagues and I joined physicians, patients, and advocates for a committee hearing and press conference where we called on the Trump administration to stop these dangerous cuts.

To learn more, you can watch the committee hearing here.

Addressing DOGE’s Access to Your Private Information

The Senate Oversight Committee recently heard testimony from IT and cybersecurity experts on the impact and potential implications of DOGE’s unfettered access to Michiganders’ personal, financial, and health information. In addition to addressing the various cybersecurity issues raised by the Trump administration’s invasion of private data, experts also shared ways individuals can protect themselves from any repercussions.

To watch the committee hearing and learn more, click here.

Fighting to Safeguard Michigan Public Schools

On March 20, President Trump signed an executive order to begin dismantling the U.S. Dept. of Education — a dangerous, unconstitutional action that could result in devastating cuts to public education across the country, including funding for at-risk students, Pell Grant recipients, and other disadvantaged communities. Similarly, Michigan House Republicans recently passed their education budget, which aims to slash about $5 billion from our state’s public schools.

The Senate Appropriations Subcommittee for PreK-12 schools recently heard from stakeholders on state budget funding needs for public education here in Michigan, underscoring the urgent need for continued support and stability rather than disinvestment and uncertainty. To watch the committee hearing and learn more, click here. In recent testimony before the full Senate Appropriations Committee, similar concerns about the impact of federal decisions on Michigan’s kids and schools were raised by Dr. Michael Rice, the State Superintendent, and officials from the Michigan Dept. of Lifelong Education, Advancement, and Potential.

Tonight! Tele-Town Hall w/ Sen. Shink & Gov. Whitmer

Please join Gov. Gretchen Whitmer and me for a tele-town hall tonight, Tuesday, April 15, from 6:45 to 7:30 p.m. You can RSVP at SenatorShink.com/Events.

This is a great opportunity to share your thoughts, ask questions, and hear directly from us about what’s happening in Lansing and how it affects you. We’ll also discuss how we’re working to protect Michigan families from the impact of federal actions.

WHEN: Tuesday, April 15, 2025, from 6:45 – 7:30 p.m.

WHERE: You can RSVP at SenatorShink.com/Events

Community Conversation at Webster Township Hall

Please join me for my upcoming Community Conversation on April 23 at Webster Township Hall. This will be a great opportunity to share your thoughts and ideas with me, while also getting a firsthand update on the work we’re doing in Lansing.

WHEN: Wednesday, April 23, from 6:00 to 7:00 p.m.

WHERE: 5665 Webster Church Rd., Dexter, MI 48130

Federal Concerns Discussed at Town Hall with Congresswoman Debbie Dingell

I was glad to join Congresswoman Debbie Dingell and our Washtenaw delegation at a town hall in Ann Arbor. Over 1,000 residents turned out to tell us they’re hurting from federal cuts to jobs and programs, and they’re angry about the cruelty and chaos coming from Washington.

Celebrating and Supporting GED Students

Thank you, members of the Michigan Adult, Community & Alternative Education Association, for coming to my office and sharing your stories.

College Access Advocacy Day

It was an honor to meet with representatives of the College & Career Access Center of Jackson and other college access professionals. We talked about the importance of reducing barriers to college education so that anyone who wants to attend college, especially first-generation students, has a clearer path to success.

Norvell Township Coffee Hour

Nearly 100 residents came out to talk with me at our coffee hour in Norvell Township, voice their concerns and participate in state government. Thank you to Supervisor Bill Sutherland and the Jackson Co. Dept. on Aging.

Jackson Women’s History Council Awards

Congratulations to the phenomenal women who received Susan B. Anthony/Harriet Tubman Awards from the Jackson Women’s History Council. Your leadership and passion inspire us all!

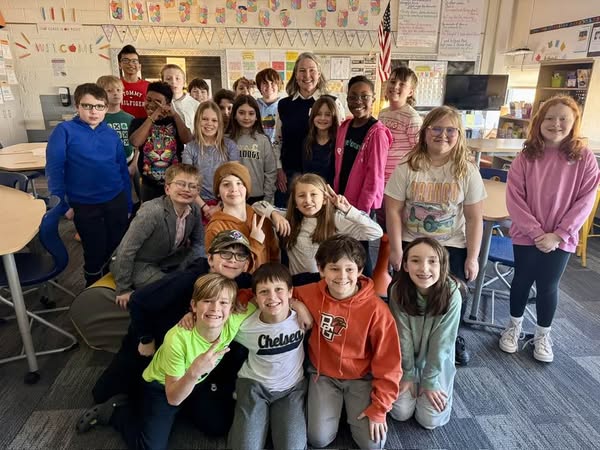

Reading Month Visits

It was a treat to visit Abbott and South Meadows elementary schools to share a book with students and listen to their ideas.

Chelsea Chamber of Commerce Awards

Congratulations to the Chelsea Area Chamber of Commerce Award winners! Lafontaine, the Crazy Diamond, Shawn Personke, Ann Nauts and Paul Schissler, and the Purple Rose Theatre.

Social Services Association Visit

Thank you, members of the Michigan County Social Services Association, for coming to Lansing. I appreciate your advocacy for our communities and neighbors. When people have the support they need, they do better!

Schools to Tools Event

Career and technical training are a vital part of education! Thank you to the Michigan Regional Council of Carpenters and Millwrights for bringing Schools to Tools to the Capitol to demonstrate how you’re introducing skilled trades to schools all over Michigan.

Michigan Taxpayers Urged to be Alert and Aware for Scammers

With Michigan individual income tax filing season winding down, the Michigan Dept. of Treasury is reminding Michiganders to be cybersecurity aware and prepared to fight tax-related identity theft.

Often, the taxpayer is already a victim of identity theft when a cybercriminal attempts to claim a state tax refund. To be cybersecurity aware and prepared to fight tax-related identity theft:

- Avoid clicking links, pop-ups, or attachments from unknown sources.

- Verify email senders by typing website names manually.

- Don’t share personal information online; legitimate organizations won’t ask for it.

- Review privacy settings on social media to limit information sharing.

- Trust your instincts; if something seems too good to be true, it probably is.

- Use strong passwords (at least 12 characters) for all accounts and devices.

- Never reuse passwords; choose unique ones and update them regularly.

- Report any suspicious activity to the proper authorities.

You can report tax fraud or identity theft to the IRS and the Federal Trade Commission at IdentityTheft.gov.

To learn more about the state Treasury Department, go to Michigan.gov/Treasury. Additional information about state individual income taxes can be found at Michigan.gov/IncomeTax.

Be sure to only connect to secure, password-protected networks.

Michigan Treasury Reminds Seniors About Tax Credits and Other Benefits

Older Michiganders have important tax credits and subtractions they can use this tax season to lower their tax bill or provide a refund, according to the Michigan Department of Treasury.

These eligible benefits include the Homestead Property Tax Credit, the Home Heating Credit and the Retirement and Pension Benefits Subtraction. Often, uninformed individuals may miss permitted tax deductions.

“I encourage seniors to seek out a qualified tax professional and investigate the Michigan tax benefits they may be eligible to receive,” State Treasurer Rachael Eubanks said. “You may qualify for low to no cost tax assistance from IRS-trained and certified volunteers. Taking advantage of tax programs and available resources can lead to more income for groceries, prescriptions, housing costs and other needs on a fixed income.”

Homestead Property Tax Credit

The Homestead Property Tax Credit is a benefit for qualified Michigan homeowners and renters, helping to pay some of the property taxes billed.

Details about your income, property and living situation impact the allowable credit amount. For guidance, visit Treasury’s new Homestead Property Tax Credit webpages.

Home Heating Credit

The Home Heating Credit is a tax benefit for qualified Michigan homeowners and renters with low to moderate income, helping to pay some of their heating expenses.

The maximum credit a taxpayer can claim may change each year. For qualifications and guidance, visit Treasury’s Home Heating Credit webpages.

Individuals who do not qualify for the Home Heating Credit may qualify for other assistance through the Michigan Department of Health and Human Services. The Low Income Home Energy Assistance Program (LIHEAP) helps households with high energy bills, shut off notices and home energy repairs.

Retirement and Pension Benefits Subtraction

For retirees, the Retirement and Pension Benefits Subtraction is a reduction of all eligible retirement income from your Michigan taxable income. Retirement income is reported on Form 1099-R for federal tax purposes and includes defined benefit pensions, IRA distributions and most payments from defined contribution plans.

Tax Year 2024 is the second year of the retirement tax rollback phase-in. This new law allows you to choose the most advantageous subtraction for your retirement and pension benefits.

For qualifications and guidance, visit Treasury’s refreshed Retirement and Pension Benefits webpages. These pages include a Retirement and Pension Estimator that can help individuals determine the eligible deduction and subtraction with the greatest value.

Need Filing Assistance?

For assistance filing a tax return, seniors are encouraged to visit michiganfreetaxhelp.org, irs.treasury.gov/freetaxprep or dial 2-1-1. Connect with your local Area Agency on Aging to learn about tax support and services available in your area.

In addition, electronic filing and direct deposit is fast, convenient, and safe. Details are available at mifastfile.org.

Allow at least 4 weeks from the date you receive your e-filed state tax return confirmation to receive your refund.

Last year, of the approximately 5 million returns received by Treasury, Michigan taxpayers e-filed more than 91% of those returns. For more information about e-filing, go to mifastfile.org.

Severe Weather Resources

From a dangerous ice storm knocking out power for thousands of Northern Michiganders to severe thunderstorms ripping through the lower peninsula, our state has recently faced significant storm damage. Here are some resources that may be useful in the aftermath of recent severe weather:

- To report downed power lines:

- DTE: outage.dteenergy.com/report-down-line

- Consumers Energy: Call 1-800-477-5050

- Lansing BWL: Call 1-877-295-5001

- For storm recovery resources, visit michigan.gov/egle/about/organization/materials-management/storm-recovery/.

- For insurance help, visit michigan.gov/difs/consumers/disaster-prep/tornado-severe-storms.

- For additional resources and safety tips, visit Michigan.gov/miready.

Continued Support for Federal Workers Impacted by Federal Layoffs and Funding Cuts

To support federal workers who may have recently lost their jobs, the Michigan Dept. of Labor and Economic Opportunity (LEO) has compiled several resources to offer support. A new, comprehensive webpage, Michigan.gov/FederalWorkerHelp, provides impacted federal workers with easy access to unemployment, job search, and community resources.

Workers who recently lost their jobs through no fault of their own may be eligible to apply for temporary financial assistance through the Unemployment Insurance Agency (UIA) as well.

UIA has resources in place to help any laid off federal worker, including:

- UIA Claimant Roadmap: An easy-to-follow, six-step guide to applying for and understanding unemployment benefits.

- Online Coaching Sessions: Web-based guidance from UIA staff who walk users through the steps needed to complete an application and qualify for payments.

- UIA Community Connect: This program partners with local groups to provide guidance for workers from underserved groups who have faced barriers when filing for jobless benefits.

- Schedule an Appointment: Schedule either an in-person, phone or virtual appointment to speak with a UIA Customer Service Agent.

- Looking for Work: Tips to understanding your responsibilities when it comes to conducting and documenting your successful work searches.

- Assistance with Setting Up an Account: Workers must create a MiLogin account before setting up a MiWAM account.

For additional assistance, workers can find FAQs, videos, and other resources at Michigan.gov/UIA. To reach an agent or unlock a MiWAM or MiLogin account, you can reach a customer service representative at 866-500-0017.

In partnership with LEO’s Office of Employment and Training, Michigan Works! agencies are also available to assist affected federal workers. Services offered include:

- Basic Career Services, which are available to all workers seeking services.

- Individualized Career Services, which are designed for workers who are unable to obtain employment through basic career services alone.

- Training Services, which are necessary to equip workers with the skills needed to obtain and retain employment.

To connect with your local Michigan Works! service center, call 800-285-WORKS (9675) or visit Michigan.gov/MichiganWorks.

MDOT Announces US-127 Bridge Maintenance Work in Jackson County

County: Jackson

Highway: US-127

Closest community: Clarklake

Start date: Monday, April 14, 2025

Estimated end date: Tuesday, Nov. 25, 2025

Traffic restrictions: This project will require closing one lane of US-127 in each direction over the Grand River. Motorists should expect delays.

Jobs numbers: Based on economic modeling, this $908,000 investment is expected to directly and indirectly support nine jobs.

Safety benefit: Performing regular maintenance on bridges helps improve and extend the service life of these structures. Closing lanes during this type of work is necessary to provide the safest work area possible for crews and motorists.